Our Strategy

It is one of the greatest challenges of our time: meeting the world's growing energy demand while tackling climate change. We aim to provide the energy people need and to implement our solutions for a net zero future.

Our purpose is to provide the world with sustainable and affordable energy and actively contribute to the energy transition.

Wintershall Dea is a leading European independent gas and oil company. We pursue moderate growth for our international E&P business while simultaneously establishing a complementary carbon management and hydrogen business.

Our Energy Transition Pathway which is based on portfolio optimisation, emissions management, innovative technologies and offsetting, is the compass guiding us towards achieving our net zero 2030 Scope 1 and 2 target1 and to actively engaging in carbon management and hydrogen activities.

1 Scope 1 and 2 GHG emissions, operated and non-operated upstream activities at equity (share) basis

At Wintershall Dea, we are determined to play a key role in the energy transition, delivering affordable, reliable and sustainable energy to customers. Our business strategy is based on diversification and decarbonisation: moderate growth for E&P and building up a strong carbon management and hydrogen business.

Our evolution

We are seeing an increase in demand for energy products, driven by population growth and rising standards of living. At the same time, there is an urgent need to tackle climate change and to decarbonise the economy.

As a company, we developed a clear business strategy that defines how we will go forward and thrive in our new world. Our priorities are aligned with the world’s energy challenges: securing supply while tackling climate change. We pursue moderate growth of our international E&P business in existing and potential new countries through value-accretive M&A and focused exploration, while simultaneously establishing a complementary carbon management and hydrogen business. We build our future on a strong, diversified, and decarbonised portfolio. At the same time, a strong HSEQ performance remains to be our foundation.

Securing Energy: Diversification

Our goal is to deliver the energy that industry and society urgently need. We will therefore focus our E&P business on selected regions in which we are carrying out exploration and production in a responsible manner.

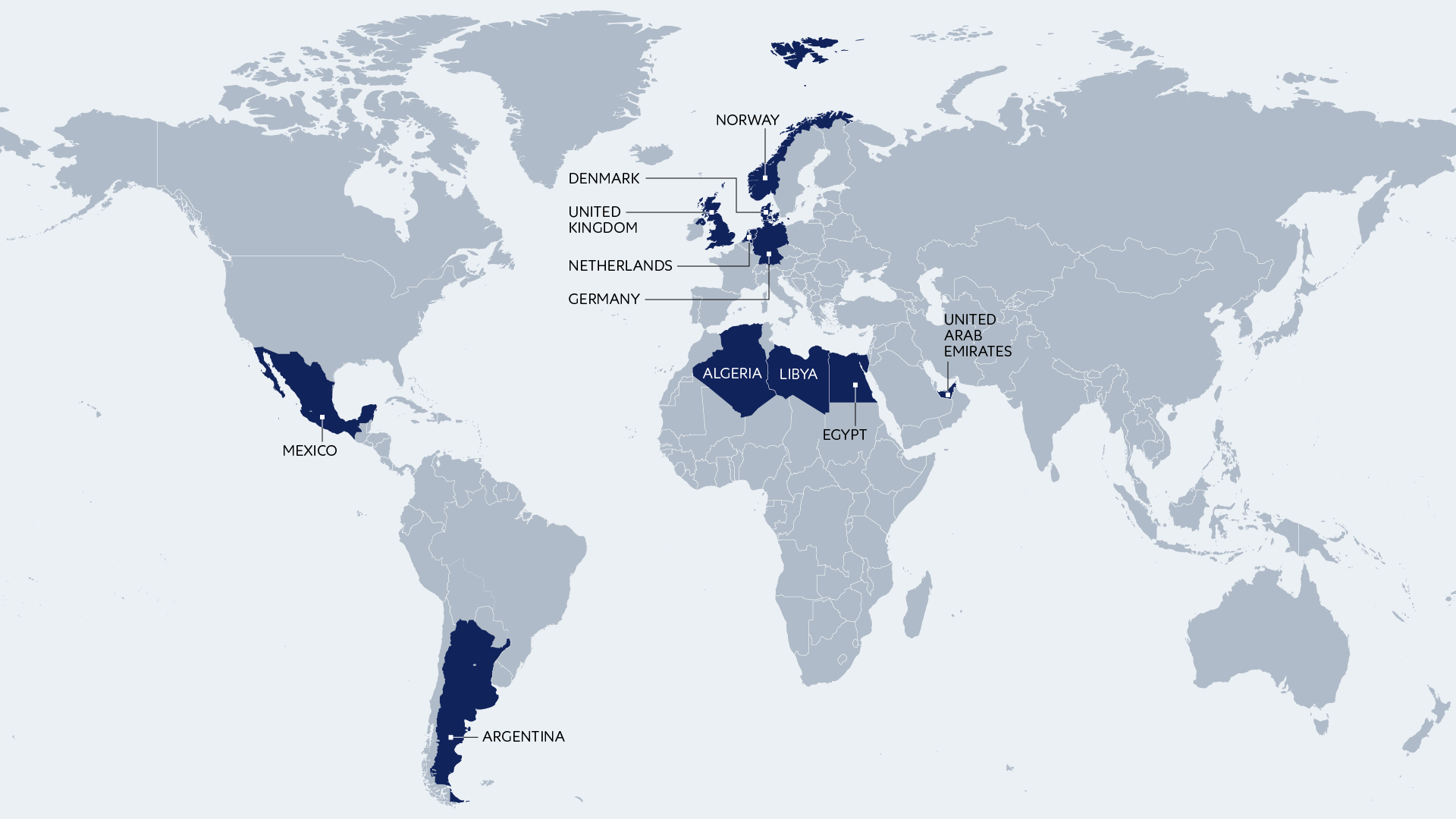

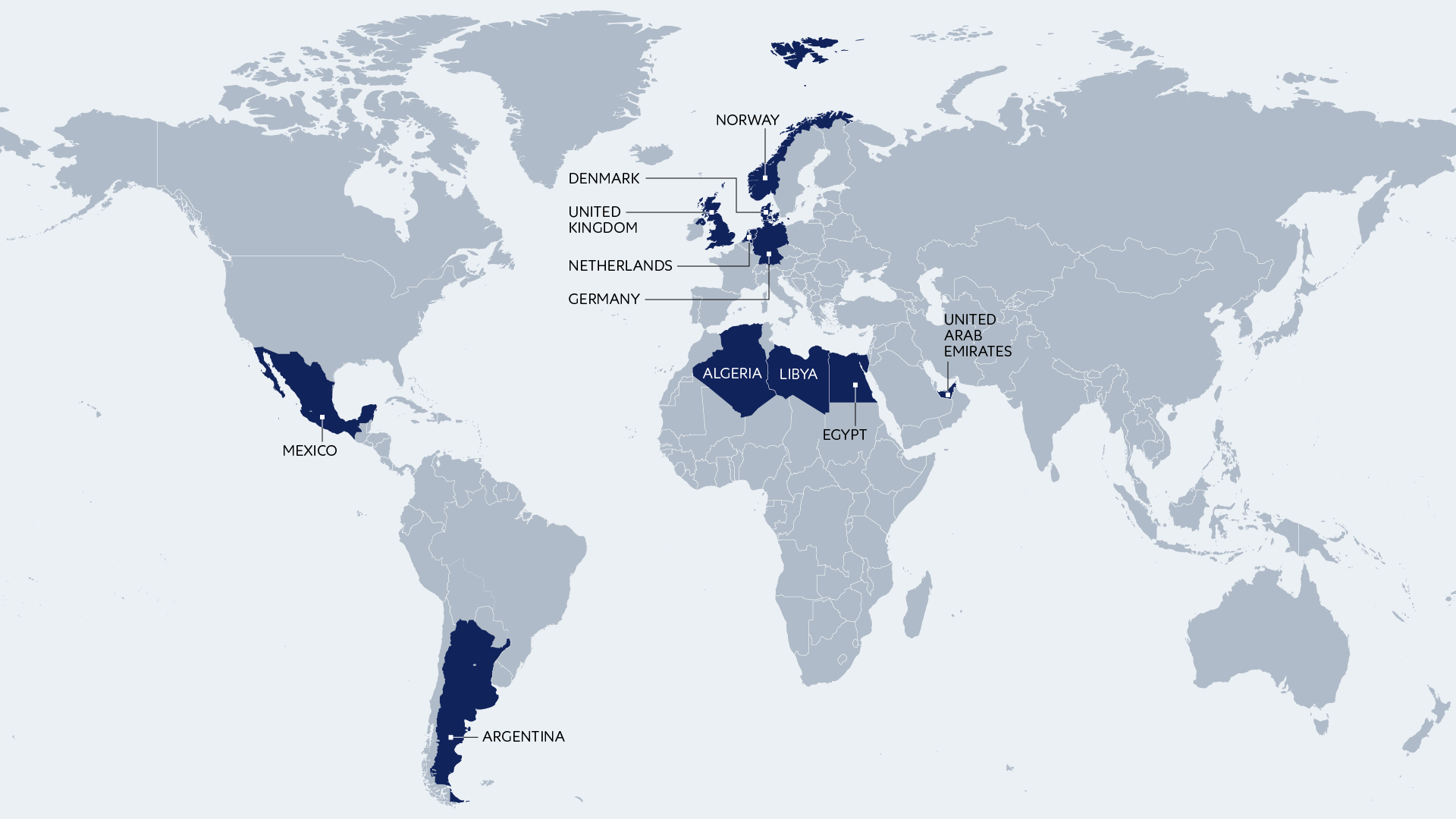

We have a long history as an E&P company, exploring and producing worldwide in the most efficient and responsible way. From our beginnings in Germany at the end of the 19th century until today, we are active in 11 countries.

We continue to concentrate on increasing the resilience and returns of our already attractive portfolio through low-cost operations and constant portfolio high grading, for example by diversifying our business in Norway, Algeria, Egypt, Argentina and Mexico.

We will renew and diversify our portfolio to significantly strengthen our reserves base and moderately grow production to 350-400 mboe/d. To reach our goals, we will pursue sizable value-accretive M&A opportunities and highly focused exploration while striving for operatorship were possible and feasible.

Natural gas and oil continue to be essential for supplying energy around the world, for fair, global prosperity. We will continue delivering the gas and oil the world needs – in an efficient and responsible way.

Towards Net Zero: Decarbonisation

Changing and evolving have been embodied in the DNA of our company for over 120 years now. Climate protection and a reliable low-carbon energy supply are social and political necessities. We believe in our technical and business competencies as the foundation to position ourselves in future key areas.

Our gas-weighted portfolio, Carbon Capture and Storage (CCS) and natural gas-based hydrogen complement each other along our Energy Transition Pathway. Therefore, Wintershall Dea has established a carbon management and hydrogen unit in 2020 to strategically drive forward projects in the areas of low-carbon hydrogen and CCS.

Our geographical starting point and focus is North-West Europe. In Germany, we are planning a hydrogen production plant and a CO2 hub (BlueHyNow and CO2nnectNow); in Denmark, we are involved in the CCS project Greensand and, together with a consortium, are driving forward the construction of the Greenport Scandinavia CO2 hub. In Norway, we hold two CCS licences, Luna and Havstjerne. In the United Kingdom, we have secured the licences Camelot and Poseidon.

We do all this to make European CCS infrastructure a reality because it is crucial, safe and a key part of our future. And we are underlying our ambition to help Europe reach its climate targets.

March

2023

first CO2 injection as part of the Greensand CCS project

About

2,000

employees worldwide

11

countries in four regions

We are also planning projects to produce hydrogen, the energy source of the future, e.g. in Wilhelmshaven on the German North Sea coast. Here, Wintershall Dea is part of a group of companies working together on establishing the so-called Energy Hub, a new centre for Germany’s energy supply. It could cover more than half of Germany’s hydrogen demand by 2030.

Hydrogen can be produced in large quantities from natural gas, using CCS to capture and store emissions generated in the production process. By producing hydrogen, we aim to decarbonise the industry, meet the energy needs and at the same time ensure its competitiveness.

Our Capabilities

Strategically, we leverage our extensive capabilities and experience to strengthen our portfolio. We also continue to actively engage in CM&H projects.

Overall, our strategy is to sustain operational excellence to safeguard our licence to operate. We do so by building on our existing strengths and capabilities as well as by expanding, developing and deploying the necessary skill sets to facilitate the transition to a low-carbon world.

The foundations of our work are efficient processes and swift decisions based on strong data management and digital skills as well as innovative technologies.

Robust Financial Framework

To achieve our goals, we follow a robust financial framework with a clear hierarchy of priorities to deliver competitive returns.

Our strong balance sheet is the foundation for competitive shareholder returns through progressive base dividend payments and flexibility for additional returns.

We will enhance underlying returns via disciplined capital allocation to sustain our production base and modestly grow the business to 350-400 mboe/d, focusing on value accretive investments.

We stand for sustainability, transparency, openness and fairness.