Our Energy Transition Pathway

The fight against climate change and the associated reorientations are among the biggest challenges the world is facing today. We are witnessing rising demand for energy products, driven by population growth and rising living standards, but at the same time, the requirement from society to decarbonise the economy.

At around two-third, our portfolio has one of the highest weightings of natural gas in our peer group.

The energy transition towards a low-carbon economy is far-reaching and complex, requiring government policy changes and difficult choices for consumers. Energy supply should be abundant, affordable and carbon-efficient and, at the same time, not undermine prosperity. Delivering more affordable energy while at the same time reducing greenhouse gas emissions and other pollution will require significant changes in the current energy mix.

Our climate targets and ambitions

- Net Zero activities by 2030

Our target is to reduce our Scope 1 and Scope 2 greenhouse gas emissions of our upstream activities at equity share basis by 2030.1 - Below 0.1 % methane intensity by 2025

Our target is to reduce our methane intensity to below 0.1 % by 2025.2 - Zero routine flaring

Our target is to maintain zero routine flaring of associated gas during our operations.3 - Reduce net carbon intensity

Our ambition is to manage and reduce net carbon intensity including Scope 1, 2 and 3 greenhouse gas emissions.

1 Scope 1 and 2; operated and non-operated at equity share basis

2 100% volume of methane emissions of Wintershall Dea’s operated assets divided by the volume of the own operated gas marketed

3 Commitment to the World Bank's initiative "Zero Routine Flaring by 2030"

Our role in the energy transition

At Wintershall Dea, we are determined to play a key role in the energy transition, delivering low-cost, reliable energy to customers. We have set ambitious and measurable targets to further reduce our emissions.

A smart way to produce natural gas in difficult subsea conditions: These modules were first used in the Vega field in Norway.

Why natural gas plays a crucial role

Our portfolio has one of the highest weightings of natural gas compared with other companies in our industry. Natural gas has a crucial role in the energy transition, including the switch from coal to gas in the next decade and the production of hydrogen in the years to come.

With 11 kg CO2e/boe, our GHG intensity (Scope 1, Scope 2) remains at a low level compared to the IOGP industry average of 17.7 kg CO2e/boe (2023), and we have continued to take measures to drive them lower still. For example, in Norway, the Hywind Tampen offshore floating wind power project went fully operational, producing and providing green electricity to the Gullfaks and Snorre fields. Wintershall Dea is a partner in the Hywind Tampen project through its equity share in Snorre. The Hywind Tampen wind farm is expected to meet about 35% of the electricity demand of the two fields, cutting the fields’ CO2 emissions by about 200,000 tonnes per year. For example, the power supply for our Mittelplate field in Germany was switched to 100% certified electricity from renewable sources during 2020.

Wintershall Dea strongly supports the European Union‘s 2050 carbon neutrality target. As Europe‘s leading independent gas and oil company, we want to contribute to this path by reducing greenhouse gas emissions of our activities and utilising new technologies.

The essentials: CCS and hydrogen

CCS and hydrogen are considered essential components to achieving the target set by the European Union. We believe that due to our consistent innovation management approach to identifying new business opportunities anchored in existing assets, skills and competencies, these two are part of Wintershall Dea’s DNA.

Wintershall Dea has already invested in CCS and hydrogen projects, which are central to reduce Scope 3 emissions and represent one path towards our contribution to reaching the goal of the Paris Agreement.

Hydrogen will be the fuel of the future.

How we aim to achieve our energy transition targets

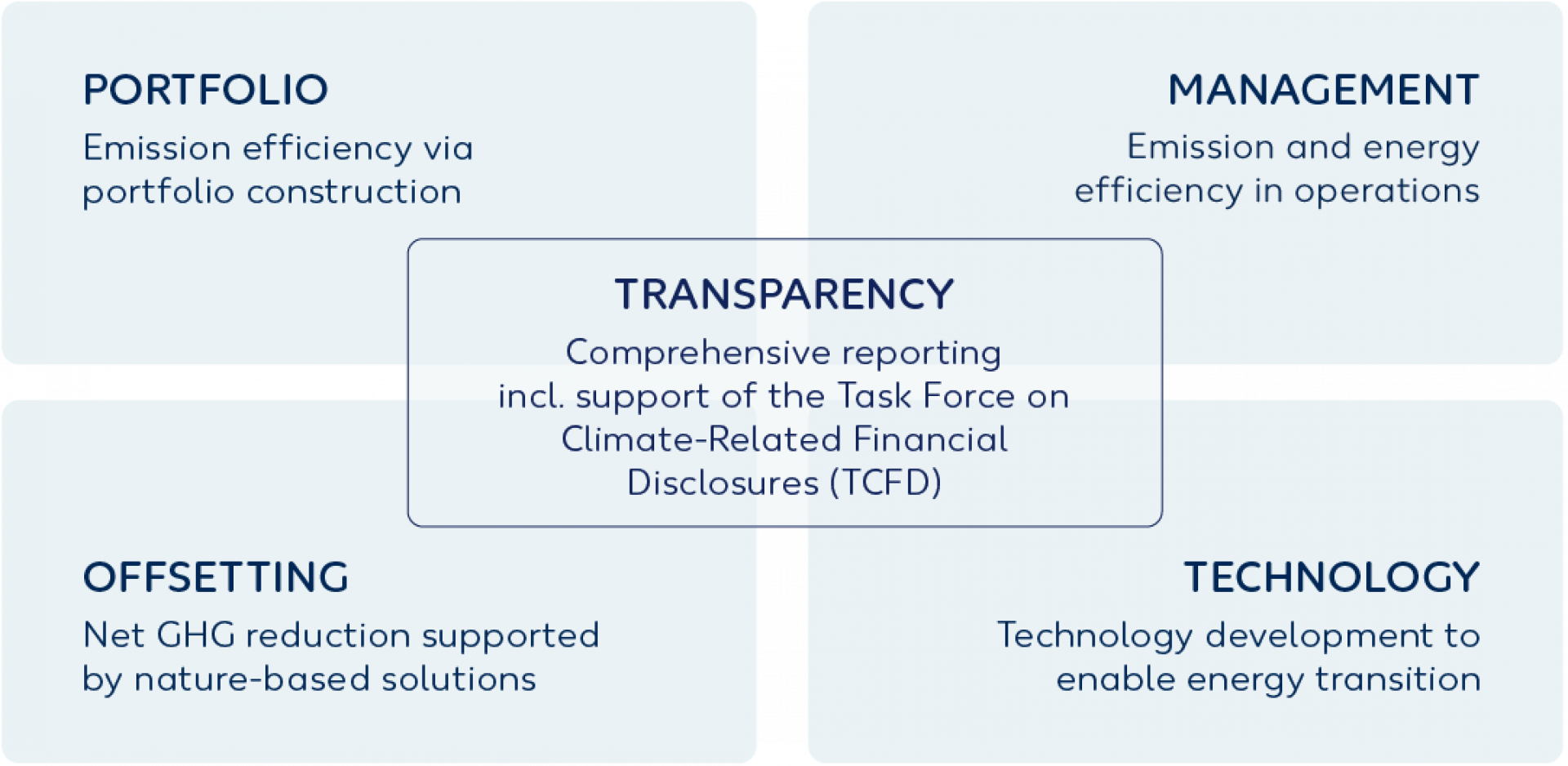

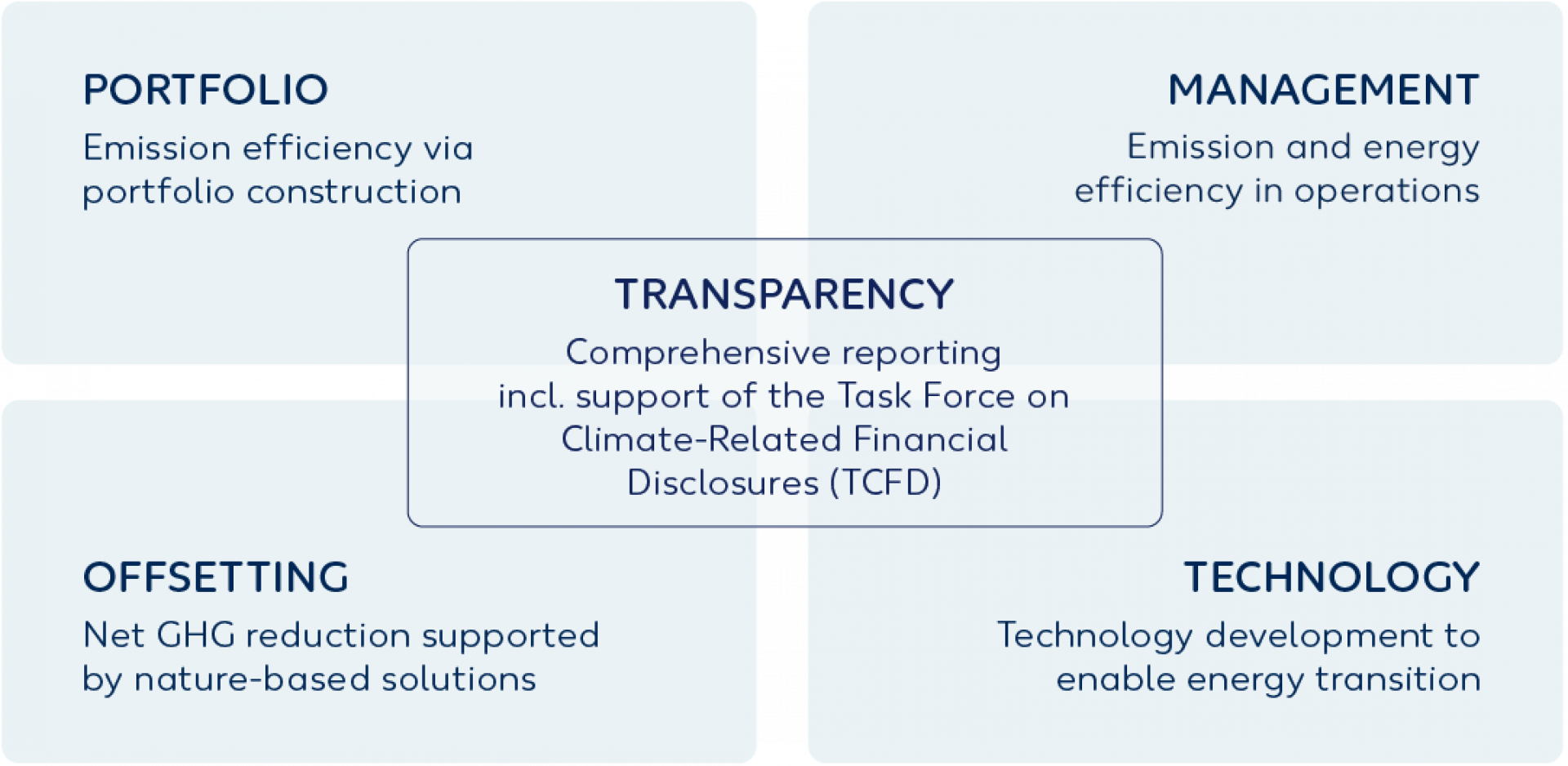

We focus on four pillars that help us respond to the challenges of climate change and are firmly anchored in our strategy.

Our Energy Transition Pathway is set to contribute to sustainable, responsible and profitable gas and oil production in a low-carbon environment.

To begin, we continuously review our portfolio, focusing on carbon-efficient assets and activities. We then implement strict emission management in all our operations by realising increasing energy efficiency, introducing electrification and using other state-of-the-art technologies. Emissions that cannot be avoided at a reasonable cost through portfolio and emissions management will be compensated through investments in nature-based solutions, such as reforestation and forest protection projects and the development and use of CCS and related hydrogen activities.