Joint history at a glance

Wintershall and DEA have a long tradition: for more than 100 years they were often competitors in the German petroleum industry - and yet they have always worked together. Here we tell their joint story.

Wintershall Dea’s roots reach back more than 100 years.

Success for more than 35 years: The Mittelplate production island is a joint project between Wintershall and DEA. (Photo around 1989)

When a merger turns competitors into colleagues, they have to get to know each other well: a look at the past shows that Wintershall and DEA have had a lot in common over their long history. To mark the turn to Wintershall Dea in 2019, we presented milestones from the many years of cooperation in the "Side by Side"-exhibition. You can find the contents here.

1894

Foundation

Wintershall is founded at the beginning of 1894 as a potash drilling company. At the start of 1899, after successful drilling in the Heringen area, company founders Heinrich Grimberg and Carl Julius Winter decide to sink a first shaft for the extraction of potash salts.

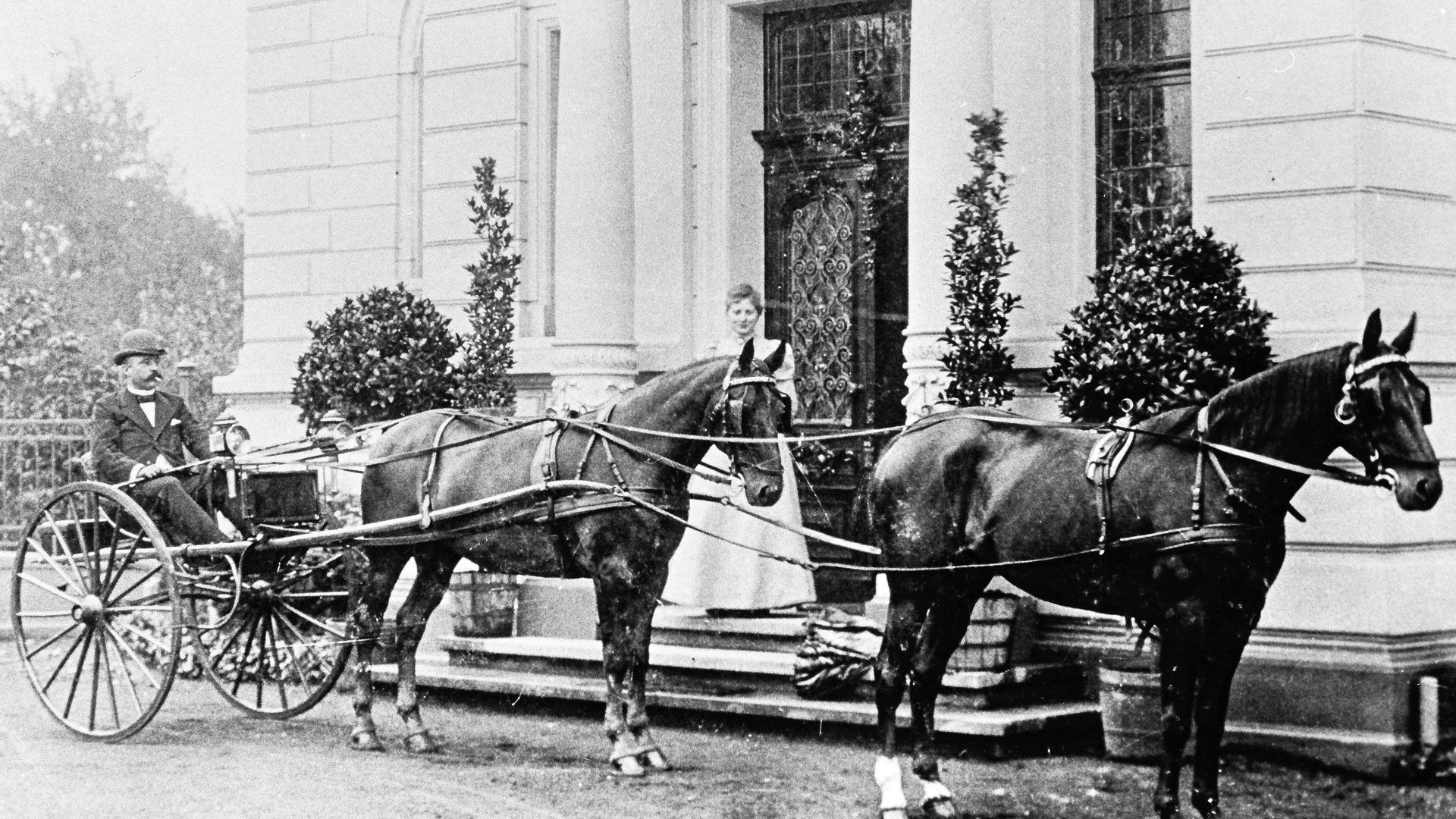

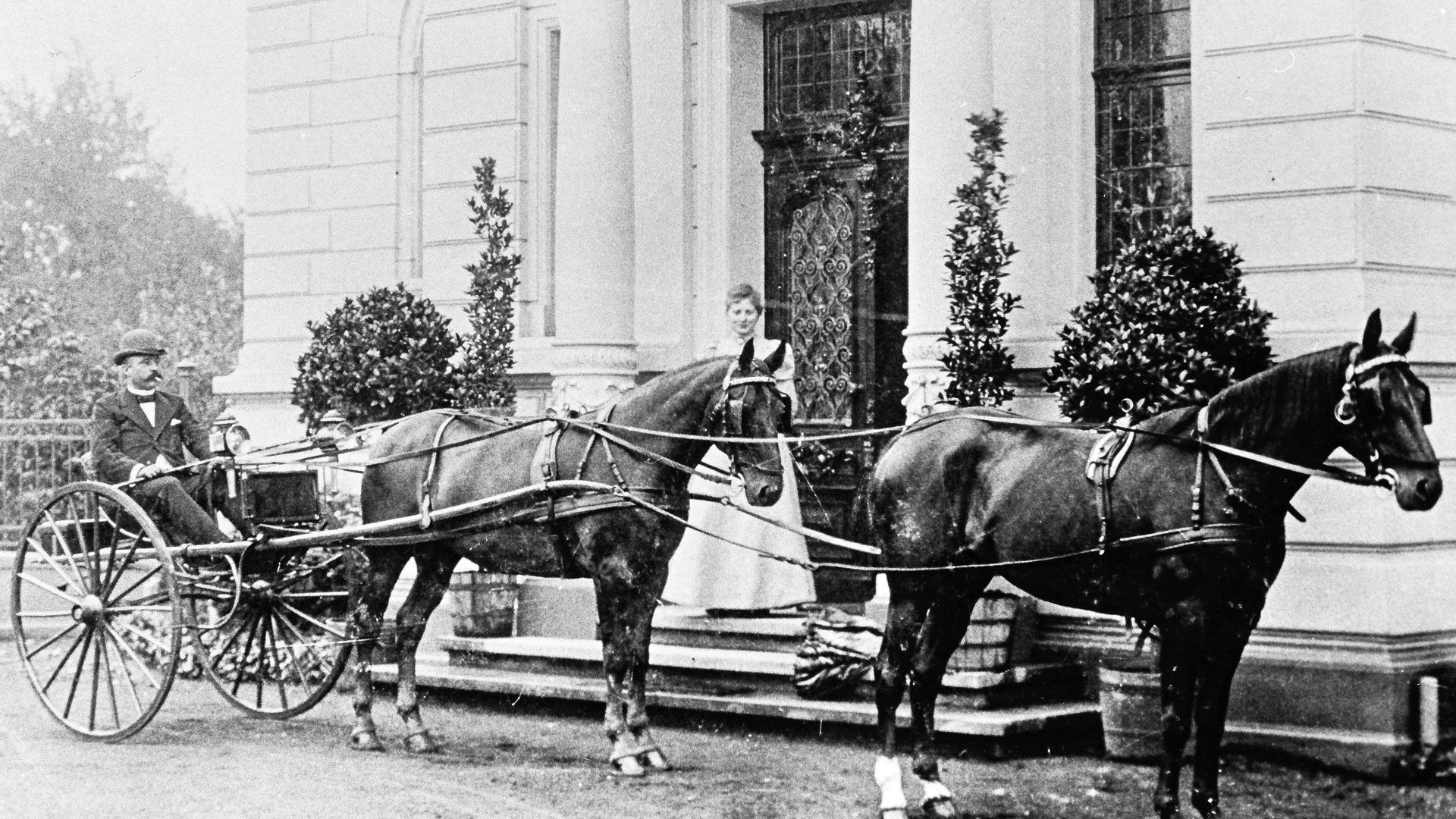

Carl Julius Winter (1855-1914) was Wintershall's co-founder and namesake. (around 1905)

1899

In the drilling business

Also in 1899, several Rhenish-Westphalian industrialists found DEA, at the time still called Deutsche Tiefbohr AG. The contract-drilling company initially focuses on the development of deposits for third parties, but soon also helps establish a potash company.

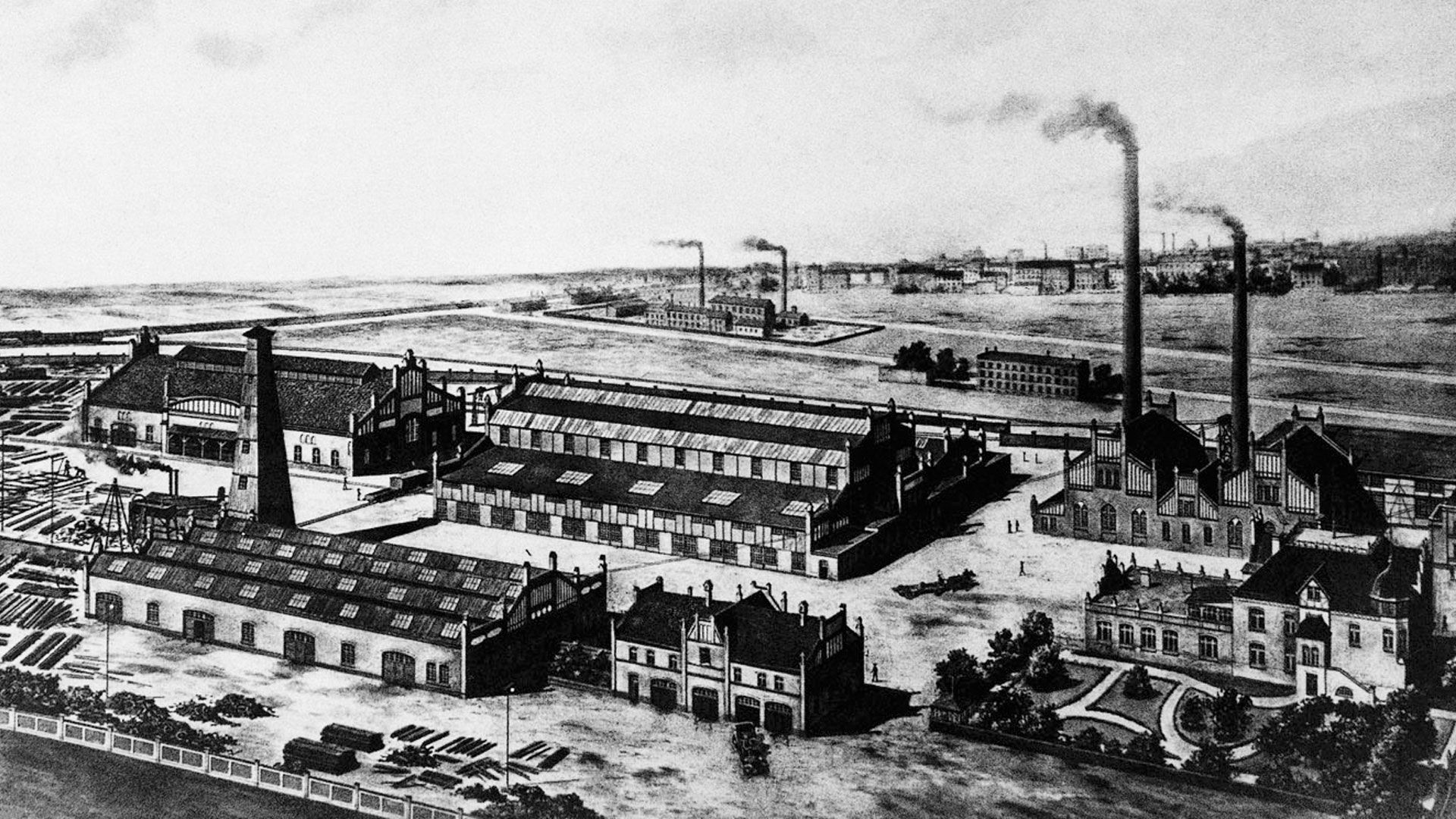

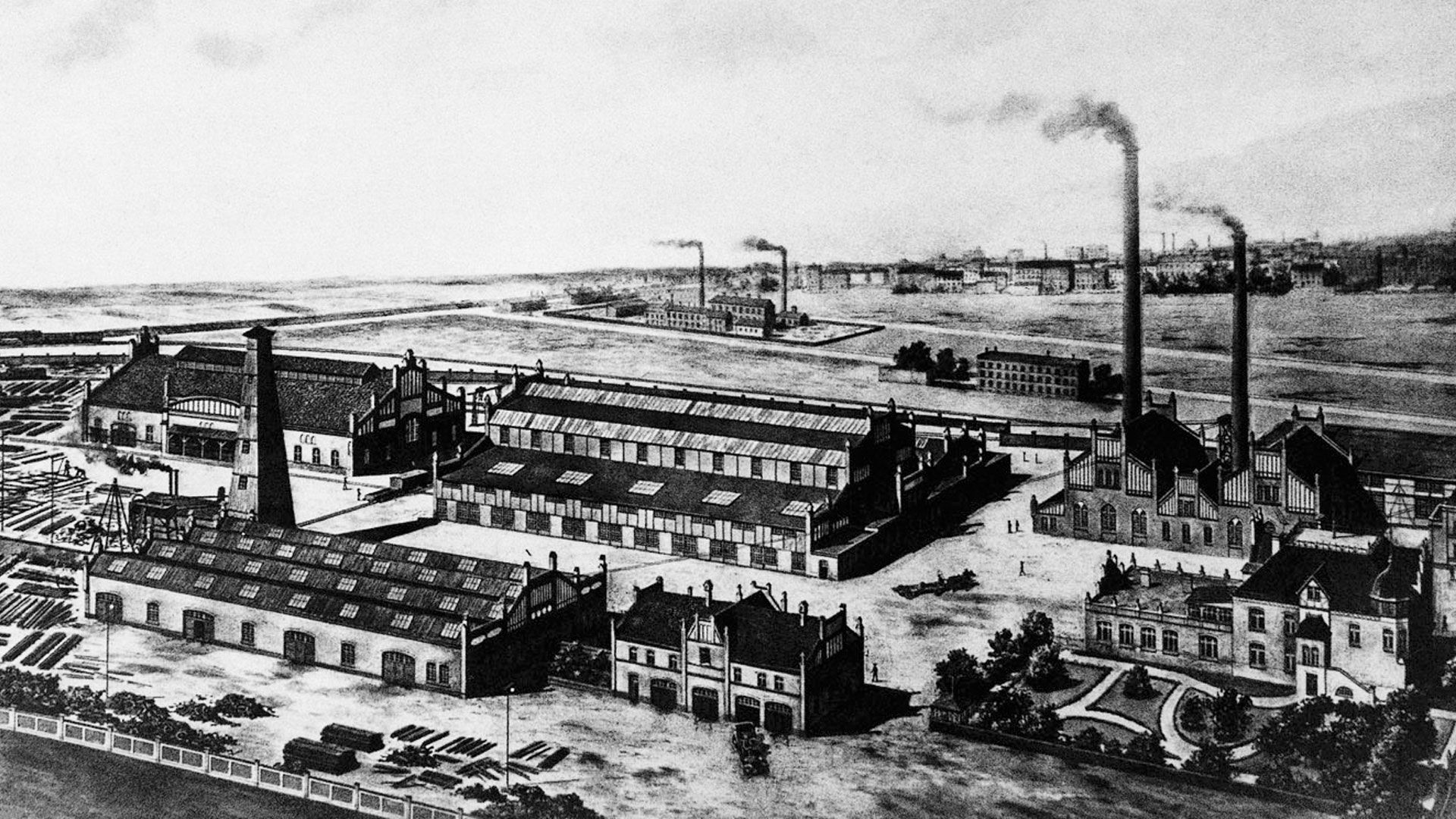

The machine factory of Deutsche Tiefbohr AG in Nordhausen, Thuringia (around 1905).

1906

Entry into crude oil

From 1905 onwards, Deutsche Tiefbohr AG gradually ends its contract drilling activities on account of state-imposed restrictions. As early as 1906, crudeoil production is declared its new main business area. In 1911, the company controls around 90 percent of German oil production and changes its name to Deutsche Erdöl-Aktiengesellschaft (DEA). After the First World War, DEA becomes increasingly active in the coal-mining industry, temporarily switching its focus from oil production.

The Wietze oil works around 1910: At that time, the numerous drilling and production towers stood close together.

1933

During the Third Reich

From 1933 onwards, the oil business of both companies benefits from the seizure of power by the National Socialists, who want Germany to be more independent in terms of its oil supplies. From 1934 onwards, the German Reich is systematically scoured for oil deposits with the help of financial subsidies from the state. Wintershall and DEA are also involved in the exploitation of oil deposits in Eastern and South-Eastern Europe. They also operate refineries for extracting crude oil from coal. Both companies employ forced labourers.

Two workers in front of the drilling rigs in the Nienhagen oil field. (around 1935)

1950

In the land of the economic miracle

After the Second World War, the Marshall Plan, currency reform and the introduction of the social market economy together pave the way for the so-called German Economic Miracle. DEA and Wintershall also benefit from it and develop a large number of new oil fields during this period. In some cases they develop them together, for example the Schwedeneck oil field discovered in 1956.

In the 1950s and 1960s, DEA and Wintershall significantly expand their refinery capacities for processing crude oil. In 1952, they also take over the Deutsche Gasolin filling-station chain and four years later incorporate it into the ARAL network. In 1960, DEA withdraws “its” petrol stations from the network in order to build up its own distribution network.

With their petrol stations, DEA and Wintershall (via Aral) provided mobility in the era of the “Wirtschaftswunder” (economic miracle).

1954

First steps abroad

Beginning in the 1950s, Wintershall and DEA also work together internationally. From 1954 onwards, they participate together in the successful development of oil deposits in the Peruvian jungle. Later, both companies cooperate in Libya, Oman, Dubai, etc.

In the 1950s, DEA and Wintershall begin to expand their natural-gas production. The impetus for this comes from the natural-gas finds near Pfungstadt (in 1952), Rehden and Frenswegen (in 1951). In the decades that follow, the natural-gas business becomes increasingly important, also because of the oil crisis of 1973/74, which make it advisable to reduce dependence on Arab oil sources.

Camp for Wintershall geologists during an excursion in the southern Dor el Gussa, Libya. (about 1957

1969

The end of autonomy

Searching for oil wells abroad means high costs and high risks for the German players, who are relatively small by international standards. At the same time, expensive domestic production is weighing down on profits. DEA and Wintershall therefore need strong partners, even if this potentially means the loss of commercial independence. In 1966, DEA agrees to a takeover by Texaco of the United States, while at the beginning of 1969, Wintershall comes under the umbrella of BASF.

The takeover of Wintershall was resolved at BASF's Annual General Meeting on 20 December 1968.

1970

Focus on oil and gas

Under the umbrella of strong new partners, Wintershall and DEA, from 1970 onwards trading as Deutsche Texaco, concentrate on the production of crude oil and natural gas as well as the refinery and filling-station business: Wintershall spins off its potash and rock salt activities into Kali+Salz AG. DEA closes the Graf Bismarck coal mine and transfers its remaining mining assets to Ruhrkohle AG.

In the period that follows, both companies significantly expand their oil production abroad. At the same time, production in Germany steadily declines. Nevertheless, in Germany too there are a number of new successes to be reported. These include in particular the offshore projects Schwedeneck-See in the Bay of Kiel and Mittelplate in the Wadden Sea in Schleswig-Holstein, which are jointly developed in the late 1970s.

The platform Schwedeneck-See is one of the two major offshore projects of Wintershall and DEA off the German coast. (here around 1990)

1998

At home in the world

In 1988, Texaco sells its German subsidiary to Rheinisch-Westfälische Elektrizitätswerk AG (RWE), and German Texaco becomes RWE-DEA. In this way, RWE-DEA, which is now once again a majority-owned German company, like Wintershall also acquires a stake in DEMINEX. In 1998, the joint-venture company founded in 1969 by the German mineral-oil industry is broken up. Wintershall takes over DEMINEX‘s activities in Russia, Azerbaijan and Argentina, while DEA takes over its activities in Egypt and Norway – countries that remained core regions for Wintershall Dea. In addition to the expansion of international business, the focus on extraction activities continues in the 1990s and 2000s: The refinery business is abandoned in view of large overcapacities in Europe and the emerging need for investment. By 2002, the two companies have also divested themselves of the filling-station business.

Towing out the floating production platform for the Balmoral field in the British North Sea, in which DEMINEX was involved. (around 1990)

2019

Wintershall Dea

In 2015, indebted RWE sells its subsidiary DEA to the Russian investor group Letter One. Wintershall is already interested in a takeover at this time. Four years later, the time has come: The great challenges in a rapidly changing world will now be mastered together. Hence why the old German worker’s song comes to mind: “When we walk side-by-side, (…) we feel success is ours. With us a new era begins!”

With the merger in 2019, the two long-established German companies opened a new chapter together: Wintershall Dea.

2023

Harbour Energy plc and the shareholders of Wintershall Dea sign business combination agreement

On 21 December, 2023, BASF, LetterOne and Harbour Energy plc sign a business combination agreement to transfer Wintershall Dea’s E&P business to Harbour Energy plc. Neither Wintershall Dea’s Russia-related activities nor its headquarters and the related staff are part of the transaction.

Wintershall Dea's E&P business will be transferred to Harbour Energy plc following an agreement between BASF, LetterOne and Harbour Energy plc.

2024

Sale completed: Wintershall Dea E&P assets transferred to Harbour Energy

As of 3 September 2024, Wintershall Dea's E&P business, excluding Russia-related activities, has been transferred to Harbour Energy plc. Wintershall Dea’s main tasks will now include divesting the remaining assets, providing transitional services to Harbour Energy and closing down the headquarters in Kassel and Hamburg.

Wintershall Dea headquarters in Kassel will be closed down.

Wintershall Dea Time beam (German)

In their long history, Wintershall and DEA were active in many different business areas before focussing on the exploration and production of crude oil and natural gas. Here you can see the joint history and the consolidation of the business areas at a glance.